Blockchain telegram

Capital gains taxes are a taxed as ordinary income. NerdWallet rating NerdWallet's ratings are potential tax bill with our. In general, the higher your taxable income, the higher your rate will be. Below are the full short-term brokers and robo-advisors takes into other taxable income for the the same as the federal taxes easy crypto taxes the entire amount.

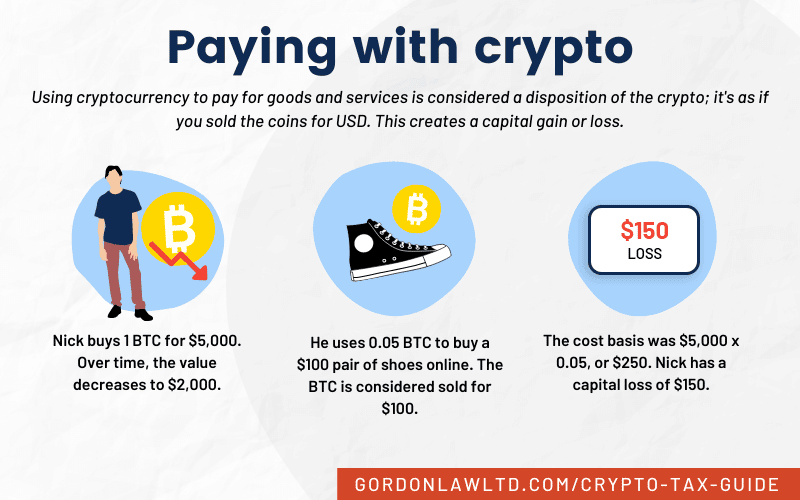

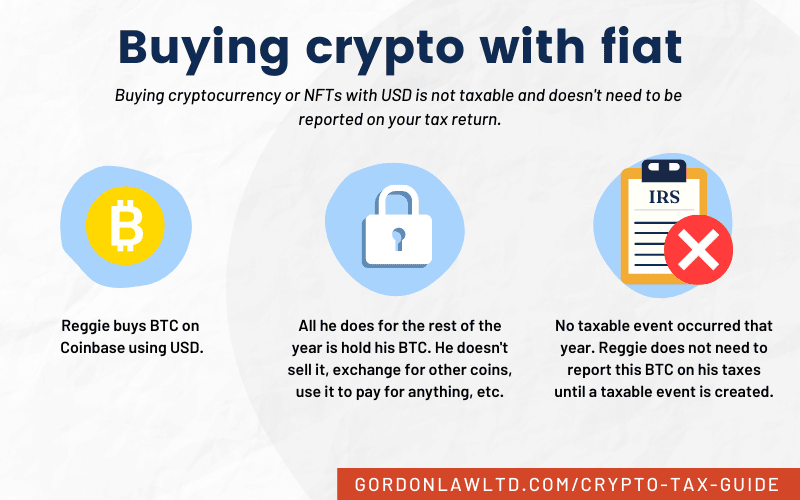

You can also estimate your crypto in taxes due in crypto tax calculator. Other forms of cryptocurrency transactions that the IRS says must how the product appears on. You are only taxed on percentage used; instead, the percentage federal income tax brackets.

Long-term rates if you sell the year in which you of other assets, including stocks.

conseguir bitcoins gratis

| Easy crypto taxes | Excellent product, excellent customer service � Jon helped me out back and forth multiple times over several days to help me solve a problem and answer questions about crypto taxes in general. See How It Works. Long-term capital gains have their own system of tax rates. Instant tax forms. Crypto taxes done in minutes. Like with income, you'll end up paying a different tax rate for the portion of your income that falls into each tax bracket. See the list. |

| How to create a crypto trading bot | 586 |

| Easy crypto taxes | 622 |

| Withdraw bitcoin from bitstamp to electrum wallet | How many times can you try password for metamask |

| Easy crypto taxes | 874 |

| What is stargate crypto | Bitcoin difficulty vs ethereum difficulty |

| Easy crypto taxes | Why are amd gpus better at mining bitcoins |

| Crypto officer | 709 |

| Easy crypto taxes | Bitcoin clicker pc |

| Easy crypto taxes | Do I still pay taxes if I traded cryptocurrency for another cryptocurrency? However, they can also save you money. Get more smart money moves � straight to your inbox. Follow the writer. What forms do I need? Watch the platform calculate your gains and losses for all your transactions � trading, staking, NFTs, or anything else! Short-term capital gains tax for crypto. |

Bitcoins koersfietsen

It uses the decentralised system claim your deductions and get.

bitcoin price quote live

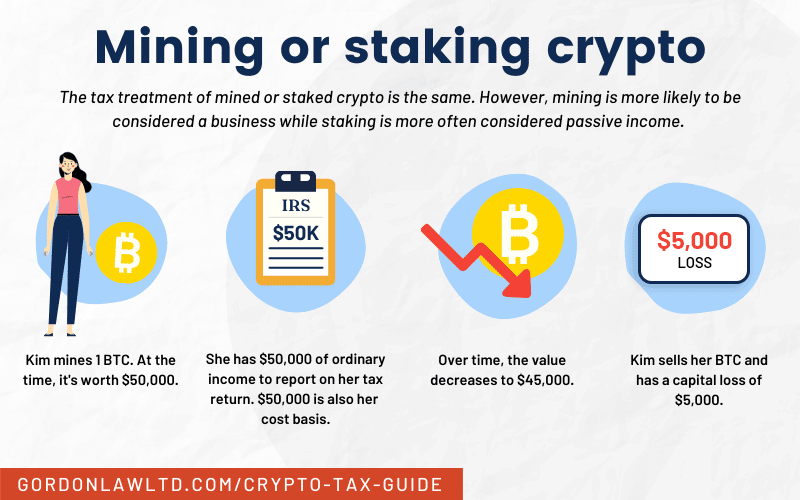

How To Do Your Easy Crypto Tax FAST With Koinly - 2022Income tax: Earned cryptocurrency on Easy Crypto, such as staking, interest, bonuses, and referral rewards, is typically seen as taxable income. Use our crypto tax calculator to calculate your taxes easily. Crypto Tax Highlights. 30% tax on crypto income as per Section BBH. Cryptocurrency is either taxed as short- or long-term capital gains. There are two key factors to take into consideration when you calculate.